import matplotlib.pyplot as plt

import numpy as np

import pandas as pd

import pandas_datareader as pdr

import yfinance as yfHerron Topic 1 - Practice for Section 02

FINA 6333 for Spring 2024

1 Announcements

- DataCamp

- Data Manipulation with pandas due by Friday, 2/9, at 11:59 PM

- Joining Data with pandas due by Friday, 2/16, at 11:59 PM

- Earn 10,000 XP due by Friday, 3/15, at 11:59 PM

- I posted Project 1 to Canvas

- Slides and notebook due by Friday, 2/23, at 11:59 PM

- Keep joining teams and let me know if you need help

2 10-Minute Recap

%precision 4

pd.options.display.float_format = '{:.4f}'.format

%config InlineBackend.figure_format = 'retina'First, we will use two packages to download data from the web:

yfinancefor Yahoo! Finance datapandas-datareaderfor Ken French data (and FRED data)

Second, there are “simple returns” and “log returns”

- Simple returns are the returns that investors receive that we learned in FINA 6331 and FINA 6333: \(r_t = \frac{p_t + d_t - p_{t-1}}{p_{t-1}}\)

- Log returns are the log of one plus simple returns. Why do we use them?

- Log returns are additive, while simple returns are multiplicative. This additive property makes math really easy with log returns: \(\log(\prod_{t=0}^T (1 + r_t)) = \sum_{t=0}^T \log(1+r_t)\), so \(r_{0,T} = \prod_{t=0}^T (1 + r_t) - 1 = e^{\sum_{t=0}^T \log(1+r_t)} - 1\)

- Log returns are almost normally distributed

We will almost always use simple returns. The exeception is time-consuming calculations, which we will often do in log returns to save us time.

Third, we can calculate portfolio returns a few ways

- We can calculate equally-weighted returns with

returns.mean(axis=1), rebalanced at the same frequency as returns - We can calculate any-weighted with

returns.dot(weights), whereweightsis an array of portfolio weights that are not necessarily equally-weighted, still rebalanced at the same frequency as returns

3 Practice

3.1 Download all available daily price data for tickers TSLA, F, AAPL, AMZN, and META to data frame prices

tickers = 'TSLA F AAPL AMZN META'

# tickers = ['TSLA', 'F', 'AAPL', 'AMZN', 'META']

prices = yf.download(tickers=tickers)

prices[*********************100%%**********************] 5 of 5 completed| Adj Close | Close | ... | Open | Volume | |||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| AAPL | AMZN | F | META | TSLA | AAPL | AMZN | F | META | TSLA | ... | AAPL | AMZN | F | META | TSLA | AAPL | AMZN | F | META | TSLA | |

| Date | |||||||||||||||||||||

| 1972-06-01 | NaN | NaN | 0.2419 | NaN | NaN | NaN | NaN | 2.1532 | NaN | NaN | ... | NaN | NaN | 0.0000 | NaN | NaN | NaN | NaN | 1091238 | NaN | NaN |

| 1972-06-02 | NaN | NaN | 0.2414 | NaN | NaN | NaN | NaN | 2.1492 | NaN | NaN | ... | NaN | NaN | 2.1532 | NaN | NaN | NaN | NaN | 1174468 | NaN | NaN |

| 1972-06-05 | NaN | NaN | 0.2414 | NaN | NaN | NaN | NaN | 2.1492 | NaN | NaN | ... | NaN | NaN | 2.1492 | NaN | NaN | NaN | NaN | 5209582 | NaN | NaN |

| 1972-06-06 | NaN | NaN | 0.2387 | NaN | NaN | NaN | NaN | 2.1248 | NaN | NaN | ... | NaN | NaN | 2.1492 | NaN | NaN | NaN | NaN | 1424158 | NaN | NaN |

| 1972-06-07 | NaN | NaN | 0.2373 | NaN | NaN | NaN | NaN | 2.1127 | NaN | NaN | ... | NaN | NaN | 2.1248 | NaN | NaN | NaN | NaN | 675088 | NaN | NaN |

| ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... | ... |

| 2024-02-05 | 187.6800 | 170.3100 | 11.5900 | 459.4100 | 181.0600 | 187.6800 | 170.3100 | 11.5900 | 459.4100 | 181.0600 | ... | 188.1500 | 170.2000 | 12.0100 | 469.8800 | 184.2600 | 69668800.0000 | 55081300.0000 | 81026800 | 40832400.0000 | 134294400.0000 |

| 2024-02-06 | 189.3000 | 169.1500 | 12.0700 | 454.7200 | 185.1000 | 189.3000 | 169.1500 | 12.0700 | 454.7200 | 185.1000 | ... | 186.8600 | 169.3900 | 11.6400 | 464.0000 | 177.2100 | 43490800.0000 | 42505500.0000 | 98636800 | 21655200.0000 | 122676000.0000 |

| 2024-02-07 | 189.4100 | 170.5300 | 12.8000 | 469.5900 | 187.5800 | 189.4100 | 170.5300 | 12.8000 | 469.5900 | 187.5800 | ... | 190.6400 | 169.4800 | 12.7300 | 458.0000 | 188.1800 | 53439000.0000 | 47174100.0000 | 137224000 | 23066000.0000 | 111535200.0000 |

| 2024-02-08 | 188.3200 | 169.8400 | 12.8300 | 470.0000 | 189.5600 | 188.3200 | 169.8400 | 12.8300 | 470.0000 | 189.5600 | ... | 189.3900 | 169.6500 | 12.8700 | 468.3200 | 189.0000 | 40962000.0000 | 42316500.0000 | 68653900 | 18815100.0000 | 83034000.0000 |

| 2024-02-09 | 188.8500 | 174.4500 | 12.6800 | 468.1100 | 193.5700 | 188.8500 | 174.4500 | 12.6800 | 468.1100 | 193.5700 | ... | 188.6500 | 170.9000 | 12.8100 | 472.9500 | 190.1800 | 43728065.0000 | 56886544.0000 | 46925766 | 18159624.0000 | 84009121.0000 |

13035 rows × 30 columns

3.2 Calculate all available daily returns and save to data frame returns

returns = (

prices['Adj Close'] # slice adj close

.iloc[:-1] # drop the last price because it might be intraday (i.e., not a close)

.pct_change() # calculate simple returns

)

returns| AAPL | AMZN | F | META | TSLA | |

|---|---|---|---|---|---|

| Date | |||||

| 1972-06-01 | NaN | NaN | NaN | NaN | NaN |

| 1972-06-02 | NaN | NaN | -0.0019 | NaN | NaN |

| 1972-06-05 | NaN | NaN | 0.0000 | NaN | NaN |

| 1972-06-06 | NaN | NaN | -0.0113 | NaN | NaN |

| 1972-06-07 | NaN | NaN | -0.0057 | NaN | NaN |

| ... | ... | ... | ... | ... | ... |

| 2024-02-02 | -0.0054 | 0.0787 | 0.0033 | 0.2032 | -0.0050 |

| 2024-02-05 | 0.0098 | -0.0087 | -0.0453 | -0.0328 | -0.0365 |

| 2024-02-06 | 0.0086 | -0.0068 | 0.0414 | -0.0102 | 0.0223 |

| 2024-02-07 | 0.0006 | 0.0082 | 0.0605 | 0.0327 | 0.0134 |

| 2024-02-08 | -0.0058 | -0.0040 | 0.0023 | 0.0009 | 0.0106 |

13034 rows × 5 columns

3.3 Slices returns for the 2020s and assign to returns_2020s

returns_2020s = returns.loc['2020':] # always use an unambiguos date format, like YYYY-MM-DD

returns_2020s| AAPL | AMZN | F | META | TSLA | |

|---|---|---|---|---|---|

| Date | |||||

| 2020-01-02 | 0.0228 | 0.0272 | 0.0129 | 0.0221 | 0.0285 |

| 2020-01-03 | -0.0097 | -0.0121 | -0.0223 | -0.0053 | 0.0296 |

| 2020-01-06 | 0.0080 | 0.0149 | -0.0054 | 0.0188 | 0.0193 |

| 2020-01-07 | -0.0047 | 0.0021 | 0.0098 | 0.0022 | 0.0388 |

| 2020-01-08 | 0.0161 | -0.0078 | 0.0000 | 0.0101 | 0.0492 |

| ... | ... | ... | ... | ... | ... |

| 2024-02-02 | -0.0054 | 0.0787 | 0.0033 | 0.2032 | -0.0050 |

| 2024-02-05 | 0.0098 | -0.0087 | -0.0453 | -0.0328 | -0.0365 |

| 2024-02-06 | 0.0086 | -0.0068 | 0.0414 | -0.0102 | 0.0223 |

| 2024-02-07 | 0.0006 | 0.0082 | 0.0605 | 0.0327 | 0.0134 |

| 2024-02-08 | -0.0058 | -0.0040 | 0.0023 | 0.0009 | 0.0106 |

1033 rows × 5 columns

What if we want a more complicated slice? We can combine .loc[] and Boolean conditions!

returns.loc[

(returns.index.year == 2020) &

((returns.index.month == 1) | (returns.index.month == 12))

]| AAPL | AMZN | F | META | TSLA | |

|---|---|---|---|---|---|

| Date | |||||

| 2020-01-02 | 0.0228 | 0.0272 | 0.0129 | 0.0221 | 0.0285 |

| 2020-01-03 | -0.0097 | -0.0121 | -0.0223 | -0.0053 | 0.0296 |

| 2020-01-06 | 0.0080 | 0.0149 | -0.0054 | 0.0188 | 0.0193 |

| 2020-01-07 | -0.0047 | 0.0021 | 0.0098 | 0.0022 | 0.0388 |

| 2020-01-08 | 0.0161 | -0.0078 | 0.0000 | 0.0101 | 0.0492 |

| 2020-01-09 | 0.0212 | 0.0048 | 0.0011 | 0.0143 | -0.0219 |

| 2020-01-10 | 0.0023 | -0.0094 | -0.0011 | -0.0011 | -0.0066 |

| 2020-01-13 | 0.0214 | 0.0043 | -0.0011 | 0.0177 | 0.0977 |

| 2020-01-14 | -0.0135 | -0.0116 | 0.0054 | -0.0128 | 0.0249 |

| 2020-01-15 | -0.0043 | -0.0040 | -0.0108 | 0.0095 | -0.0361 |

| 2020-01-16 | 0.0125 | 0.0085 | -0.0022 | 0.0028 | -0.0097 |

| 2020-01-17 | 0.0111 | -0.0070 | -0.0011 | 0.0017 | -0.0058 |

| 2020-01-21 | -0.0068 | 0.0146 | 0.0055 | -0.0032 | 0.0719 |

| 2020-01-22 | 0.0036 | -0.0024 | -0.0054 | -0.0005 | 0.0409 |

| 2020-01-23 | 0.0048 | -0.0015 | -0.0022 | -0.0070 | 0.0046 |

| 2020-01-24 | -0.0029 | -0.0122 | -0.0153 | -0.0083 | -0.0129 |

| 2020-01-27 | -0.0294 | -0.0179 | -0.0122 | -0.0141 | -0.0120 |

| 2020-01-28 | 0.0283 | 0.0136 | 0.0090 | 0.0136 | 0.0159 |

| 2020-01-29 | 0.0209 | 0.0026 | 0.0045 | 0.0250 | 0.0249 |

| 2020-01-30 | -0.0014 | 0.0068 | -0.0023 | -0.0614 | 0.1030 |

| 2020-01-31 | -0.0443 | 0.0738 | -0.0023 | -0.0364 | 0.0152 |

| 2020-12-01 | 0.0308 | 0.0164 | 0.0176 | 0.0346 | 0.0302 |

| 2020-12-02 | 0.0029 | -0.0051 | -0.0043 | 0.0034 | -0.0273 |

| 2020-12-03 | -0.0011 | -0.0052 | 0.0011 | -0.0197 | 0.0432 |

| 2020-12-04 | -0.0056 | -0.0076 | 0.0141 | -0.0076 | 0.0095 |

| 2020-12-07 | 0.0123 | -0.0014 | -0.0128 | 0.0210 | 0.0713 |

| 2020-12-08 | 0.0051 | 0.0061 | 0.0033 | -0.0076 | 0.0127 |

| 2020-12-09 | -0.0209 | -0.0230 | 0.0216 | -0.0193 | -0.0699 |

| 2020-12-10 | 0.0120 | -0.0009 | -0.0349 | -0.0029 | 0.0374 |

| 2020-12-11 | -0.0067 | 0.0048 | -0.0110 | -0.0129 | -0.0272 |

| 2020-12-14 | -0.0051 | 0.0130 | -0.0122 | 0.0023 | 0.0489 |

| 2020-12-15 | 0.0501 | 0.0026 | 0.0269 | 0.0050 | -0.0103 |

| 2020-12-16 | -0.0005 | 0.0240 | -0.0120 | 0.0004 | -0.0165 |

| 2020-12-17 | 0.0070 | -0.0015 | 0.0044 | -0.0043 | 0.0532 |

| 2020-12-18 | -0.0159 | -0.0106 | -0.0143 | 0.0070 | 0.0596 |

| 2020-12-21 | 0.0124 | 0.0014 | -0.0022 | -0.0131 | -0.0649 |

| 2020-12-22 | 0.0285 | 0.0001 | -0.0157 | -0.0209 | -0.0146 |

| 2020-12-23 | -0.0070 | -0.0066 | 0.0228 | 0.0038 | 0.0088 |

| 2020-12-24 | 0.0077 | -0.0039 | -0.0145 | -0.0026 | 0.0244 |

| 2020-12-28 | 0.0358 | 0.0351 | 0.0034 | 0.0359 | 0.0029 |

| 2020-12-29 | -0.0133 | 0.0116 | -0.0079 | -0.0008 | 0.0035 |

| 2020-12-30 | -0.0085 | -0.0109 | 0.0045 | -0.0177 | 0.0432 |

| 2020-12-31 | -0.0077 | -0.0088 | -0.0079 | 0.0047 | 0.0157 |

3.4 Download all available data for the Fama and French daily benchmark factors to dictionary ff_all

I often use the following code snippet to find the exact name for the the daily benchmark factors file.

pdr.famafrench.get_available_datasets()[:5]['F-F_Research_Data_Factors',

'F-F_Research_Data_Factors_weekly',

'F-F_Research_Data_Factors_daily',

'F-F_Research_Data_5_Factors_2x3',

'F-F_Research_Data_5_Factors_2x3_daily']ff_all = pdr.DataReader(

name='F-F_Research_Data_Factors_daily',

data_source='famafrench',

start='1900'

)C:\Users\r.herron\AppData\Local\Temp\ipykernel_28696\2526882917.py:1: FutureWarning: The argument 'date_parser' is deprecated and will be removed in a future version. Please use 'date_format' instead, or read your data in as 'object' dtype and then call 'to_datetime'.

ff_all = pdr.DataReader(The DESCR key in the dictionary tells us about the data frames that pandas-datareader returns.

print(ff_all['DESCR'])F-F Research Data Factors daily

-------------------------------

This file was created by CMPT_ME_BEME_RETS_DAILY using the 202312 CRSP database. The Tbill return is the simple daily rate that, over the number of trading days in the month, compounds to 1-month TBill rate from Ibbotson and Associates Inc. Copyright 2023 Kenneth R. French

0 : (25649 rows x 4 cols)3.5 Slice the daily benchmark factors, convert them to decimal returns, and assign to ff

ff = ff_all[0].div(100)

ff| Mkt-RF | SMB | HML | RF | |

|---|---|---|---|---|

| Date | ||||

| 1926-07-01 | 0.0010 | -0.0025 | -0.0027 | 0.0001 |

| 1926-07-02 | 0.0045 | -0.0033 | -0.0006 | 0.0001 |

| 1926-07-06 | 0.0017 | 0.0030 | -0.0039 | 0.0001 |

| 1926-07-07 | 0.0009 | -0.0058 | 0.0002 | 0.0001 |

| 1926-07-08 | 0.0021 | -0.0038 | 0.0019 | 0.0001 |

| ... | ... | ... | ... | ... |

| 2023-12-22 | 0.0021 | 0.0064 | 0.0009 | 0.0002 |

| 2023-12-26 | 0.0048 | 0.0069 | 0.0046 | 0.0002 |

| 2023-12-27 | 0.0016 | 0.0014 | 0.0012 | 0.0002 |

| 2023-12-28 | -0.0001 | -0.0036 | 0.0003 | 0.0002 |

| 2023-12-29 | -0.0043 | -0.0112 | -0.0037 | 0.0002 |

25649 rows × 4 columns

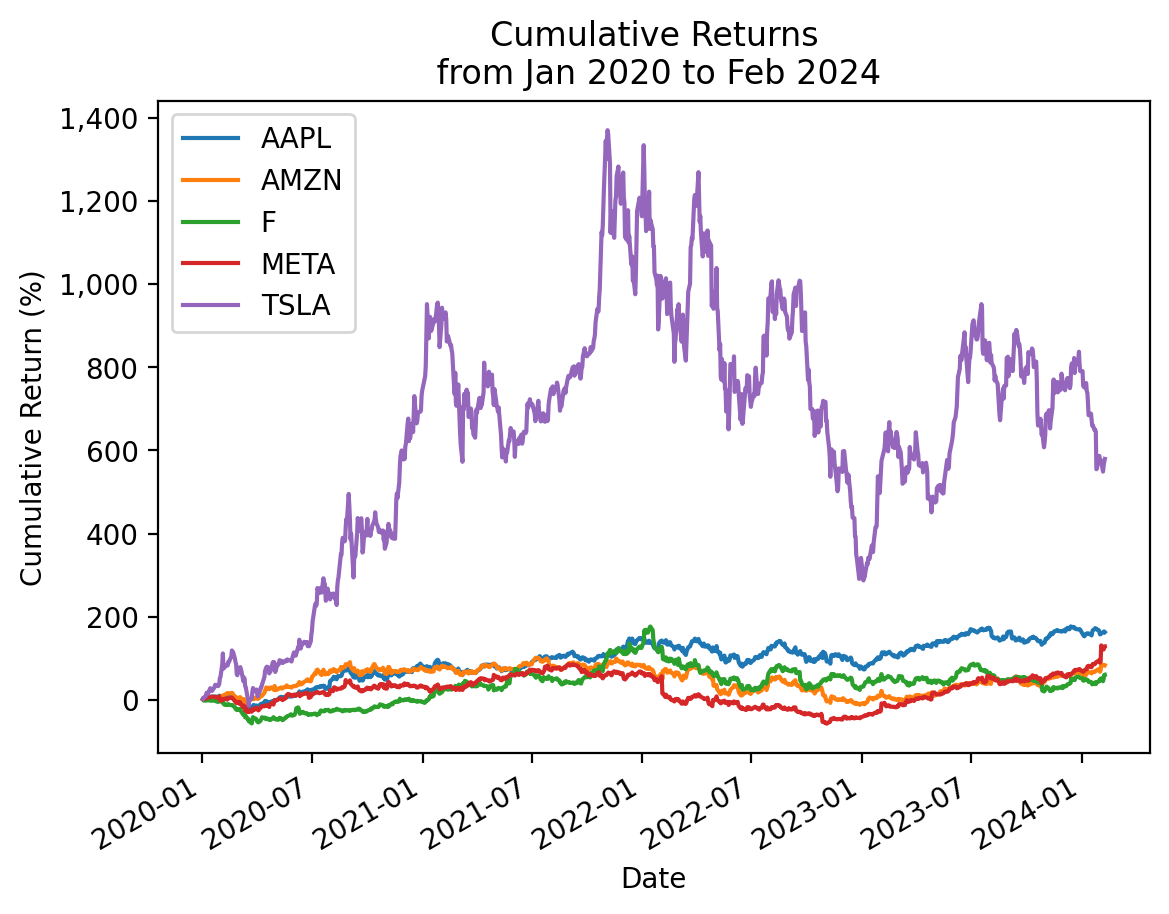

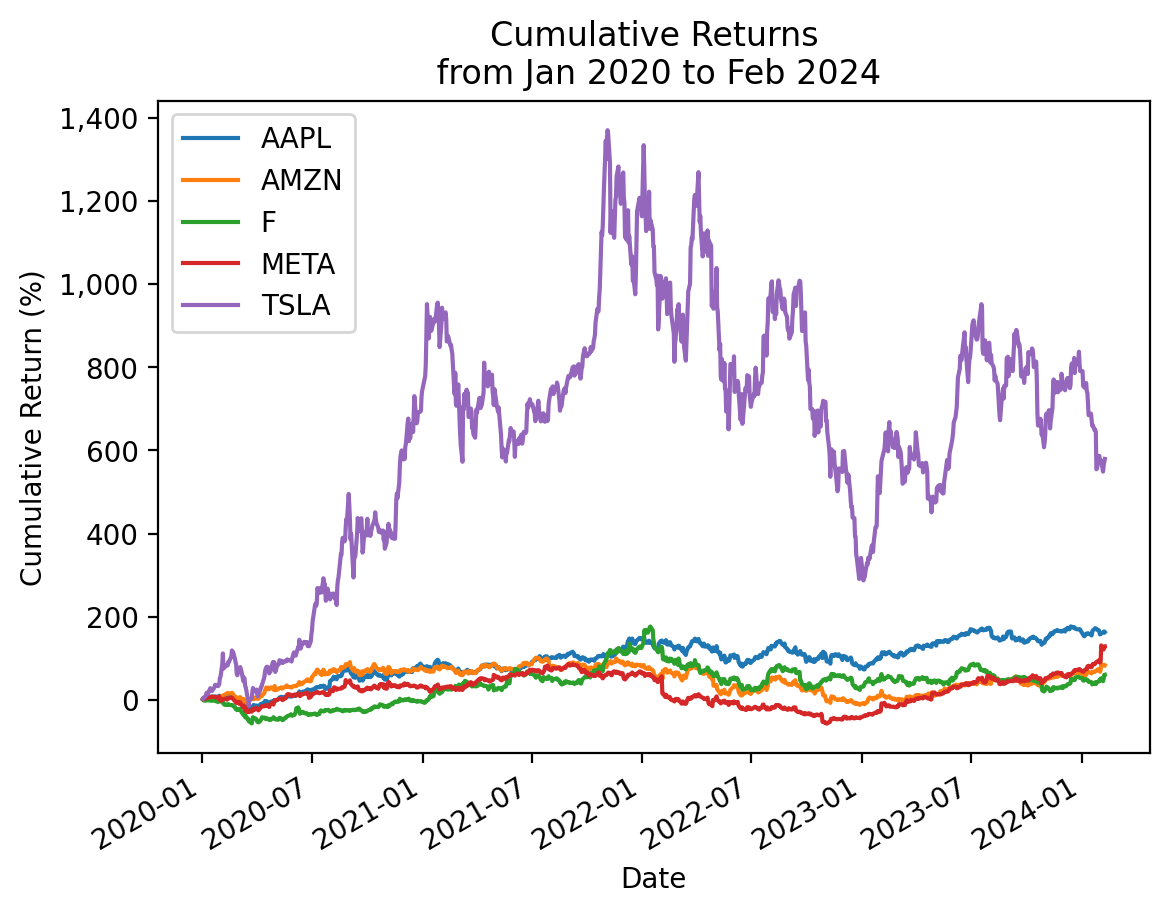

3.6 Use the .cumprod() method to plot cumulative returns for these stocks in the 2020s

We use the .prod() method to calculate total returns, because \(r_{total} = r_{0,T} = \left[ \prod_{t=0}^T (1 + r_t) \right] -1\).

totret = (

returns_2020s # returns during the 2020s

.add(1) # add 1 before we compound

.prod() # compound all returns

.sub(1) # subtract 1 to recover total returns

)

totretAAPL 1.6331

AMZN 0.8383

F 0.6090

META 1.2899

TSLA 5.7970

dtype: float64cumret_cumprod = returns_2020s.add(1).cumprod().sub(1)The last row in the cumulative returns data frame cumret_cumprod is the same as the total returns series totret!

np.allclose(totret, cumret_cumprod.iloc[-1])TrueWe can use the .plot() method to plot these cumulative returns!

cumret_cumprod.mul(100).plot()

# https://stackoverflow.com/questions/25973581/how-to-format-axis-number-format-to-thousands-with-a-comma

from matplotlib import ticker

plt.gca().get_yaxis().set_major_formatter(ticker.FuncFormatter(lambda x, p: format(int(x), ',')))

plt.ylabel('Cumulative Return (%)')

plt.title(f'Cumulative Returns\n from {cumret_cumprod.index.min():%b %Y} to {cumret_cumprod.index.max():%b %Y}')

plt.show()

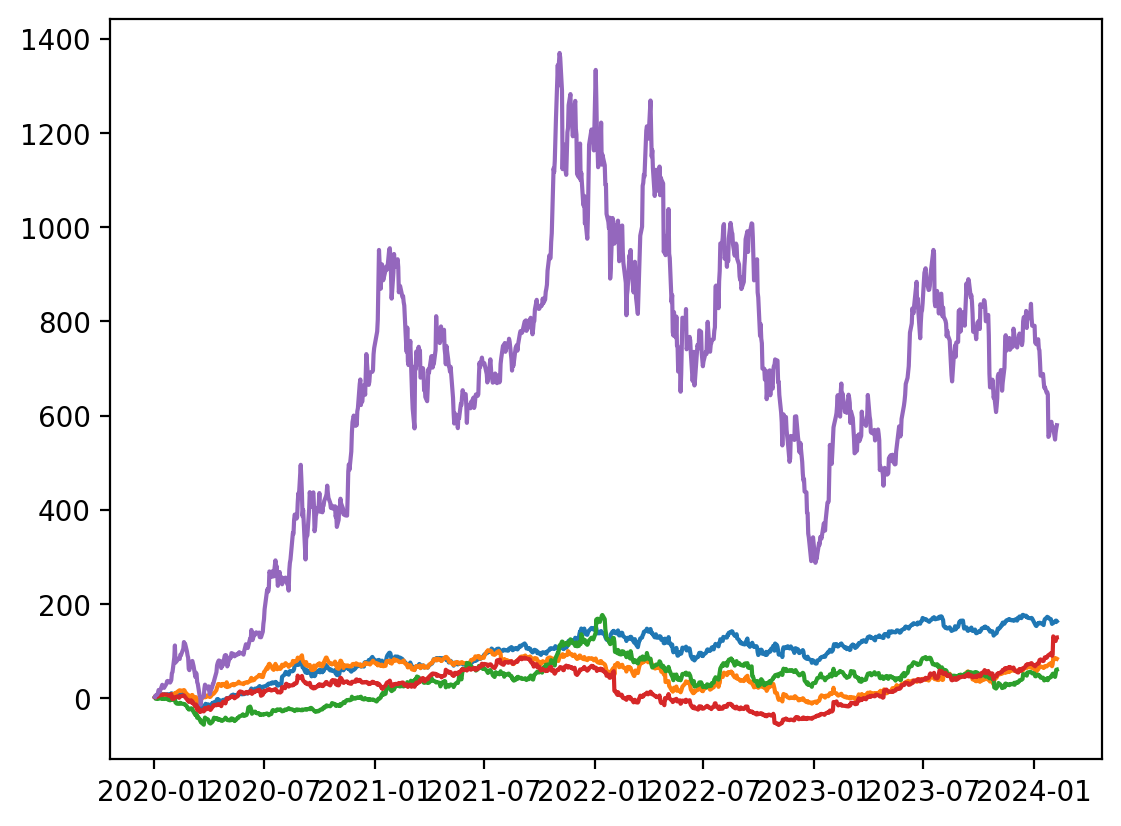

We can also plt.plot(), but lose a few of the formatting defaults built into the pandas method .plot().

plt.plot(cumret_cumprod.mul(100))

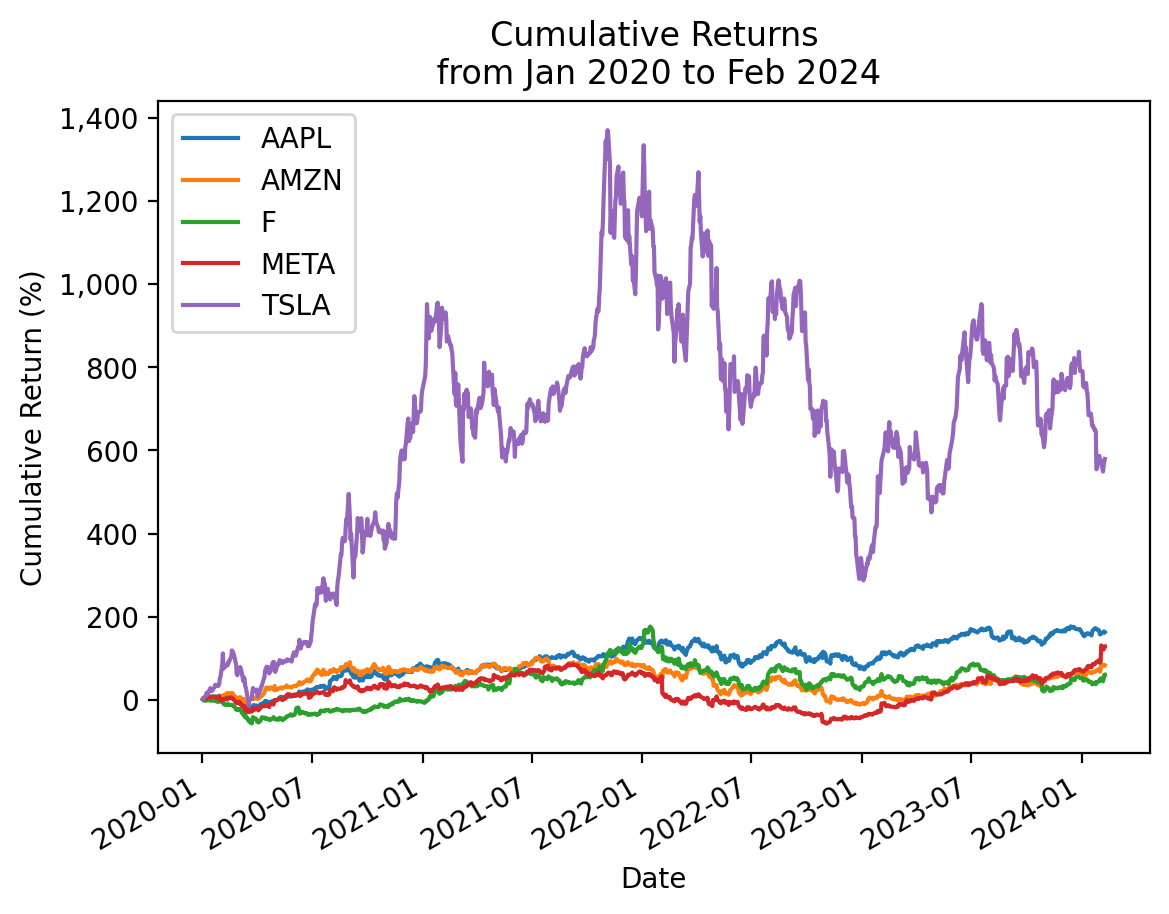

3.7 Use the .cumsum() method with log returns to plot cumulative returns for these stocks in the 2020s

cumret_cumsum = (

returns_2020s

.pipe(np.log1p) # converts simple returns to log returns

.cumsum() # log returns are additive

.pipe(np.expm1) # converts log returns to simple returns

)

# cumret_cumsum = returns_2020s.add(1).pipe(np.log).cumsum().pipe(np.exp).sub(1)np.allclose(totret, cumret_cumsum.iloc[-1])Truecumret_cumsum.mul(100).plot()

# https://stackoverflow.com/questions/25973581/how-to-format-axis-number-format-to-thousands-with-a-comma

from matplotlib import ticker

plt.gca().get_yaxis().set_major_formatter(ticker.FuncFormatter(lambda x, p: format(int(x), ',')))

plt.ylabel('Cumulative Return (%)')

plt.title(f'Cumulative Returns\n from {cumret_cumsum.index.min():%b %Y} to {cumret_cumsum.index.max():%b %Y}')

plt.show()

3.8 Use price data only to plot cumulative returns for these stocks in the 2020s

We can also calculate cumulative returns as the ratio of adjusted closes. That is \(R_{0,T} = \frac{AC_T}{AC_0} - 1\). The trick here is that \(FV_t = PV (1+r)^t\), so \((1+r)^t = \frac{FV_t}{PV}\).

returns_2020s.iloc[0]AAPL 0.0228

AMZN 0.0272

F 0.0129

META 0.0221

TSLA 0.0285

Name: 2020-01-02 00:00:00, dtype: float64Note: We drop the last row in prices['Adj Close'] with .iloc[:-1]. We drop this last row here here because we did the same above when we calculated returns to exclude possible intraday returns.

cumret_prices = prices['Adj Close'].loc['2020':].iloc[:-1] / prices['Adj Close'].loc['2019'].iloc[-1] - 1

cumret_prices.iloc[0]AAPL 0.0228

AMZN 0.0272

F 0.0129

META 0.0221

TSLA 0.0285

Name: 2020-01-02 00:00:00, dtype: float64np.allclose(cumret_cumprod, cumret_prices)Truecumret_prices.mul(100).plot()

# https://stackoverflow.com/questions/25973581/how-to-format-axis-number-format-to-thousands-with-a-comma

from matplotlib import ticker

plt.gca().get_yaxis().set_major_formatter(ticker.FuncFormatter(lambda x, p: format(int(x), ',')))

plt.ylabel('Cumulative Return (%)')

plt.title(f'Cumulative Returns\n from {cumret_prices.index.min():%b %Y} to {cumret_prices.index.max():%b %Y}')

plt.show()

3.9 Calculate the Sharpe Ratio for TSLA

Calculate the Sharpe Ratio with all available returns and 2020s returns. Recall the Sharpe Ratio is \(\frac{\overline{r_i - r_f}}{\sigma_i}\), where \(\sigma_i\) is the volatility of excess returns.

I suggest you write a function named calc_sharpe() to use for the rest of this notebook.

def calc_sharpe(ri, rf=ff['RF'], ppy=252):

ri_rf = ri.sub(rf).dropna()

return np.sqrt(ppy) * ri_rf.mean() / ri_rf.std()calc_sharpe(ri=returns['TSLA'])0.9261calc_sharpe(ri=returns_2020s['TSLA'])1.1212We can use the .pipe() method here, too, since ri is the first argument to calc_sharpe()!

returns['TSLA'].pipe(calc_sharpe)0.9261returns_2020s['TSLA'].pipe(calc_sharpe)1.12123.10 Calculate the market beta for TSLA

Calculate the market beta with all available returns and 2020s returns. Recall we estimate market beta with the ordinary least squares (OLS) regression \(R_i-R_f = \alpha + \beta (R_m-R_f) + \epsilon\). We can estimate market beta with the covariance formula (i.e., \(\beta_i = \frac{Cov(R_i - R_f, R_m - R_f)}{Var(R_m-R_f)}\)) above for a univariate regression if we do not need goodness of fit statistics.

I suggest you write a function named calc_beta() to use for the rest of this notebook.

def calc_beta(ri, rf=ff['RF'], rm_rf=ff['Mkt-RF']):

ri_rf = ri.sub(rf).dropna()

rm_rf = rm_rf.loc[ri_rf.index]

return ri_rf.cov(rm_rf) / rm_rf.var()calc_beta(ri=returns['TSLA'])1.4417calc_beta(ri=returns_2020s['TSLA'])1.5780We can use the .pipe() method here, too, since ri is the first argument to calc_beta()!

returns['TSLA'].pipe(calc_beta)1.4417returns_2020s['TSLA'].pipe(calc_beta)1.57803.11 Guess the Sharpe Ratios for these stocks in the 2020s

3.12 Guess the market betas for these stocks in the 2020s

3.13 Calculate the Sharpe Ratios for these stocks in the 2020s

How good were your guesses?

for i in returns_2020s:

sharpe_i = returns_2020s[i].pipe(calc_sharpe)

print(f'Sharpe Ratio for {i}:\t {sharpe_i:0.2f}')Sharpe Ratio for AAPL: 0.86

Sharpe Ratio for AMZN: 0.48

Sharpe Ratio for F: 0.42

Sharpe Ratio for META: 0.49

Sharpe Ratio for TSLA: 1.12We can also use pandas notation to vectorize this calculation. First calculate excess returns as \(r_i - r_f\).

returns_2020s_excess = returns_2020s.sub(ff['RF'], axis=0).dropna()Then use pandas notation to calculate means, standard deviations, and annualize.

(

returns_2020s_excess

.mean()

.div(returns_2020s_excess.std())

.mul(np.sqrt(252))

)AAPL 0.8576

AMZN 0.4750

F 0.4240

META 0.4949

TSLA 1.1212

dtype: float64Note: In a few weeks we will learn the .apply() method, which avoids the loop syntax.

returns_2020s.apply(calc_sharpe)AAPL 0.8576

AMZN 0.4750

F 0.4240

META 0.4949

TSLA 1.1212

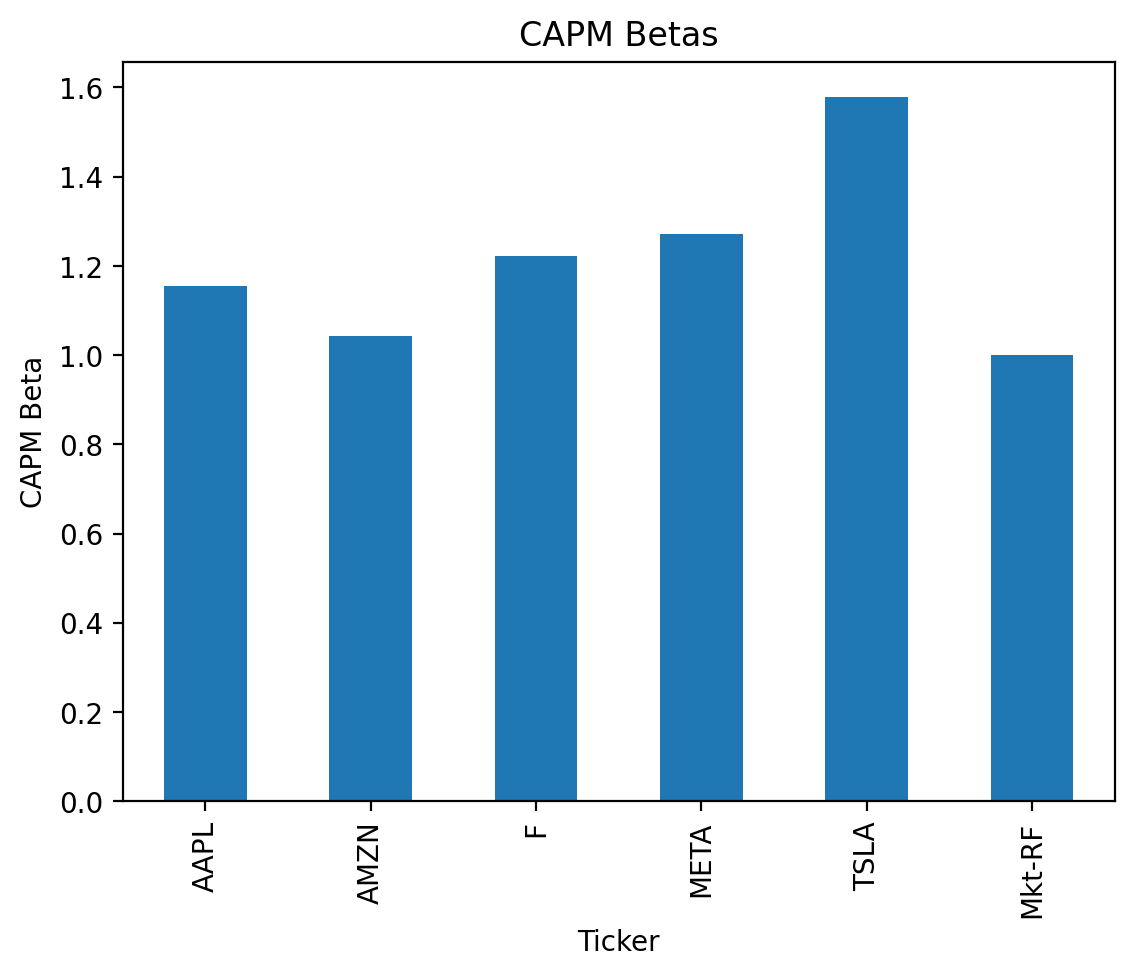

dtype: float643.14 Calculate the market betas for these stocks in the 2020s

How good were your guesses?

for i in returns_2020s:

beta_i = returns_2020s[i].pipe(calc_beta)

print(f'Beta for {i}:\t {beta_i:0.2f}')Beta for AAPL: 1.15

Beta for AMZN: 1.04

Beta for F: 1.22

Beta for META: 1.27

Beta for TSLA: 1.58Or we can follow out approach above to vectorize this calculation. First, we need to add a market excess return column to returns_2020s_excess.

returns_2020s_excess['Mkt-RF'] = ff['Mkt-RF']

returns_2020s_excess.head()| AAPL | AMZN | F | META | TSLA | Mkt-RF | |

|---|---|---|---|---|---|---|

| Date | ||||||

| 2020-01-02 | 0.0228 | 0.0271 | 0.0128 | 0.0220 | 0.0285 | 0.0086 |

| 2020-01-03 | -0.0098 | -0.0122 | -0.0224 | -0.0054 | 0.0296 | -0.0067 |

| 2020-01-06 | 0.0079 | 0.0148 | -0.0055 | 0.0188 | 0.0192 | 0.0036 |

| 2020-01-07 | -0.0048 | 0.0020 | 0.0098 | 0.0021 | 0.0387 | -0.0019 |

| 2020-01-08 | 0.0160 | -0.0079 | -0.0001 | 0.0101 | 0.0491 | 0.0047 |

vcv = returns_2020s_excess.cov()

vcv| AAPL | AMZN | F | META | TSLA | Mkt-RF | |

|---|---|---|---|---|---|---|

| AAPL | 0.0004 | 0.0003 | 0.0002 | 0.0004 | 0.0005 | 0.0003 |

| AMZN | 0.0003 | 0.0006 | 0.0002 | 0.0004 | 0.0005 | 0.0002 |

| F | 0.0002 | 0.0002 | 0.0009 | 0.0003 | 0.0005 | 0.0003 |

| META | 0.0004 | 0.0004 | 0.0003 | 0.0009 | 0.0005 | 0.0003 |

| TSLA | 0.0005 | 0.0005 | 0.0005 | 0.0005 | 0.0018 | 0.0003 |

| Mkt-RF | 0.0003 | 0.0002 | 0.0003 | 0.0003 | 0.0003 | 0.0002 |

vcv['Mkt-RF'].div(vcv.loc['Mkt-RF', 'Mkt-RF']).plot(kind='bar')

plt.xlabel('Ticker')

plt.ylabel('CAPM Beta')

plt.title('CAPM Betas')

plt.show()

Note: In a few weeks we will learn the .apply() method, which avoids the loop syntax.

returns_2020s.apply(calc_beta)AAPL 1.1541

AMZN 1.0429

F 1.2231

META 1.2710

TSLA 1.5780

dtype: float643.15 Calculate the Sharpe Ratio for an equally weighted portfolio of these stocks in the 2020s

What do you notice?

returns_2020s.mean(axis=1).pipe(calc_sharpe)0.9573Because diversification reduces portfolio standard deviation less than the sum of its parts, the Sharpe Ratio of the equally weighted portfolio is less than the equally weighted mean of the single-stock Sharpe Ratios.

returns_2020s.apply(calc_sharpe).mean()0.67453.16 Calculate the market beta for an equally weighted portfolio of these stocks in the 2020s

What do you notice?

Beta measures nondiversifiable risk, so \(\beta_P = \sum w_i \beta_i\)!

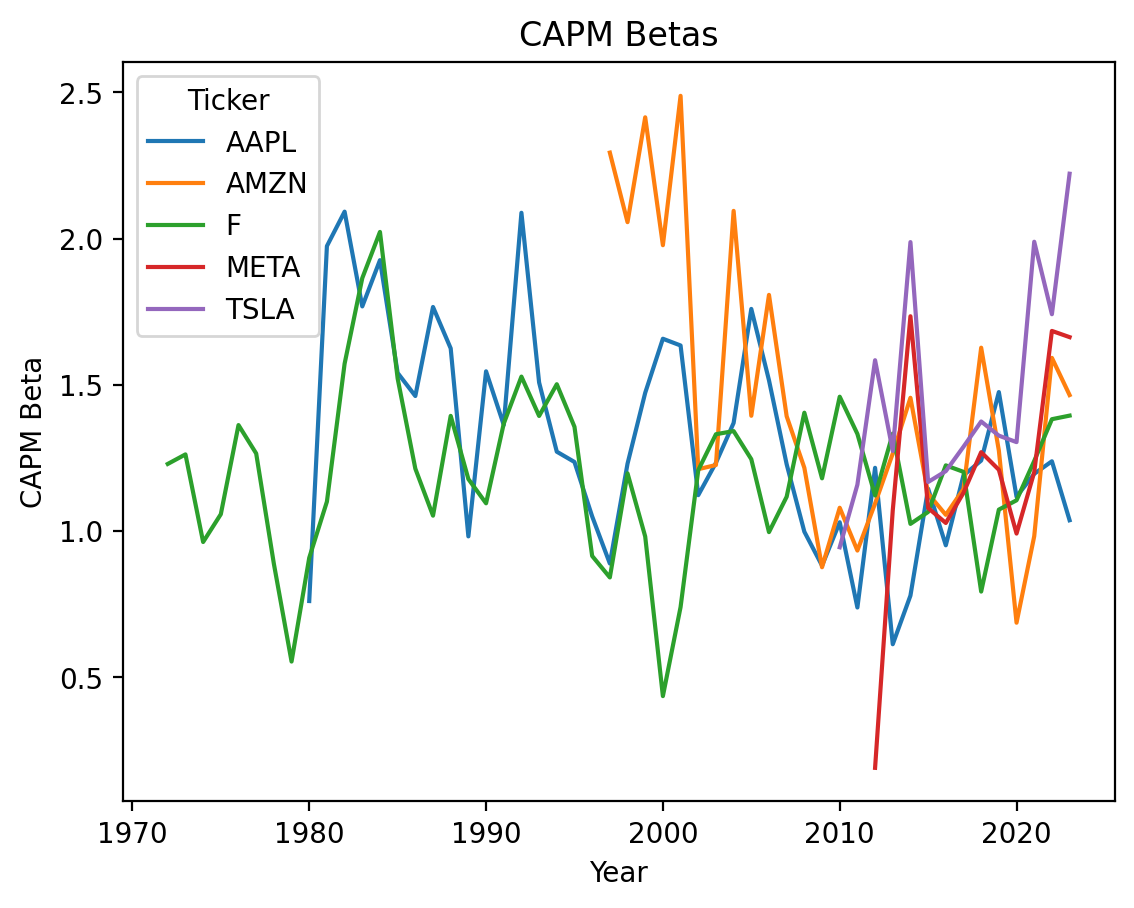

returns_2020s.mean(axis=1).pipe(calc_beta)1.2538returns_2020s.apply(calc_beta).mean()1.25383.17 Calculate the market betas for these stocks every calendar year for every possible year

Save these market betas to data frame betas. Our current Python knowledge limits us to a for-loop, but we will learn easier and faster approaches soon!

betas = pd.DataFrame(

index=range(1972, 2024),

columns=returns.columns

)

betas.columns.name = 'Ticker'

betas.index.name = 'Year'

betas.tail()| Ticker | AAPL | AMZN | F | META | TSLA |

|---|---|---|---|---|---|

| Year | |||||

| 2019 | NaN | NaN | NaN | NaN | NaN |

| 2020 | NaN | NaN | NaN | NaN | NaN |

| 2021 | NaN | NaN | NaN | NaN | NaN |

| 2022 | NaN | NaN | NaN | NaN | NaN |

| 2023 | NaN | NaN | NaN | NaN | NaN |

for i in betas.index:

for c in betas.columns:

betas.at[i, c] = returns.loc[str(i), c].pipe(calc_beta)

betas.tail()| Ticker | AAPL | AMZN | F | META | TSLA |

|---|---|---|---|---|---|

| Year | |||||

| 2019 | 1.4751 | 1.2752 | 1.0733 | 1.2094 | 1.3262 |

| 2020 | 1.1174 | 0.6866 | 1.1052 | 0.9913 | 1.3041 |

| 2021 | 1.1957 | 0.9822 | 1.2396 | 1.2014 | 1.9891 |

| 2022 | 1.2386 | 1.5922 | 1.3824 | 1.6843 | 1.7414 |

| 2023 | 1.0369 | 1.4649 | 1.3947 | 1.6630 | 2.2218 |

3.18 Plot the time series of market betas

betas.plot()

plt.ylabel('CAPM Beta')

plt.title('CAPM Betas')

plt.show()